If you are looking for how to trade and make money on Weltrade, then this article was written just for you. Trading profitably with WelTrade requires a comprehensive understanding of the platform, its features, and effective trading strategies.

Click here to register and Start Making Money on Weltrade

Table of Contents

How to Trade and Make Money on Weltrade

One of the first steps to success if you are looking for how to trade and make money on Weltrade is selecting the right account type which aligns with your trading style and financial goals. WelTrade provides several account options, such as the Micro Account for beginners, the Pro, Premium and Zulu account with different funding requirements for each of the accounts. For traders seeking accounts with better spreads, the Premium and Pro Accounts is recommended. However, these accounts require higher minimum deposits but offer more favorable trading conditions.

This can be followed by selecting effective trading strategies such as scalping, day trading and swing trading. Scalping and day trading are popular strategies that can be effectively employed on the WelTrade platform. While scalping involves making numerous trades throughout the day to capitalize on small price movements, day and swing trading requires a keen sense of market timing and discipline, as it involves opening and closing positions within or beyond the same trading day. By focusing on a highly liquid currency pairs like EUR/USD, traders can increase their chances of making profits by utilizing strategies that suit their trading preference.

Also, risk management is another cornerstone of successful trading. It involves the ability to identify potential risks associated with certain trading activities or strategies, determining the appropriate amount of capital to allocate to each trade based on your overall account size and risk tolerance and taking the trade based on the predetermined risk to reward speculation of the trader. It aims at protecting a trading capital, minimizing losses while maximizing potential gains. Thus, by understanding and implementing these concepts, traders can enhance their chances of long-term success in the financial markets. Implementing these processes requires consistent practices which may involve daily reevaluation of oneself, use of stop-loss orders at a predetermined price and staying informed about market trends by using the daily market analysis provided by WelTrade.

Lastly, taking advantage of promotional offers can significantly enhance your trading capital. WelTrade often provides bonuses for initial deposits—such as a 100% bonus on your first deposit—which can give you additional funds to trade with. However, it’s essential to understand the terms and conditions associated with these bonuses to ensure you can effectively utilize them in your trading strategy.

How to Open a Trading Account on Weltrade

To open either a demo or real account with WelTrade, kindly use click here. You will be required to input an active email which will be used to create your login details.

After creating the account, proceed to carry out the account verification. This may demand certain documentations such as identity document (Driver’s License, A passport) and a utility bill. After this is done, proceed to choose an account type to fund. This could either be the real account or trade with a demo account where virtual funding is done.

The WelTrade Dashboard

It is very important to note that when trading in MT5, WelTrade is registered as Systemgates Limited. This knowledge will save clients in searching for the wrong name

WelTrade Account Types

WelTrade offers a diverse range of account types, such as the Micro account, Premium account, Pro account and the Zulu account. Each of these accounts are designed to cater to different trading styles, experience levels, and financial goals

The Micro account

This was designed for two set of traders: beginners and those who want to start trading with minimal risk. This is because, the account accommodates no commissions, a minimum deposit of one USD ($1), a leverage of 1:1000 and a spread of 1.5 pips. This makes it an ideal starting point for novice traders or those looking to test strategies with minimal financial risk when compared to the Pro and Premium accounts that have been designed for traders with more experience and a larger trading budget.

The Premium and Pro Account

These accounts accommodate a minimum of 25 and 500 USD as their respective minimum funding. While their leverage remains the same (1:1000), WelTrade acknowledges that the speed at which trades are executed differs in each of these accounts vary. For instance, the Premium account executes trade at 0.5 seconds while the Pro accounts do that at 0.3 seconds. While these factors are important considerations for traders when choosing an account type, they also reflect the increasing level of sophistication and demands of more experienced traders. The faster execution times in the Pro account can be crucial for strategies that rely on quick entry and exit points, particularly in fast-moving market conditions. These enhanced features, combined with the higher minimum deposits, cater to traders who require more advanced tools and are prepared to manage larger positions in their trading activities.

The Zulu Trade account

The Zulu Trade account is actually designed to enable traders’ carryout trading adventures such as following proficient traders and also copying their trades for a fee. Although it does not appear as one of the primary accounts that WelTrade Broker presents on their dashboard, but it comes into play as an investment account that a trader opens while seeking to complete the copy trading requirements. To achieve this, a minimum funding of 200 USD is required.

The WelTrade Synthetic Indices Account

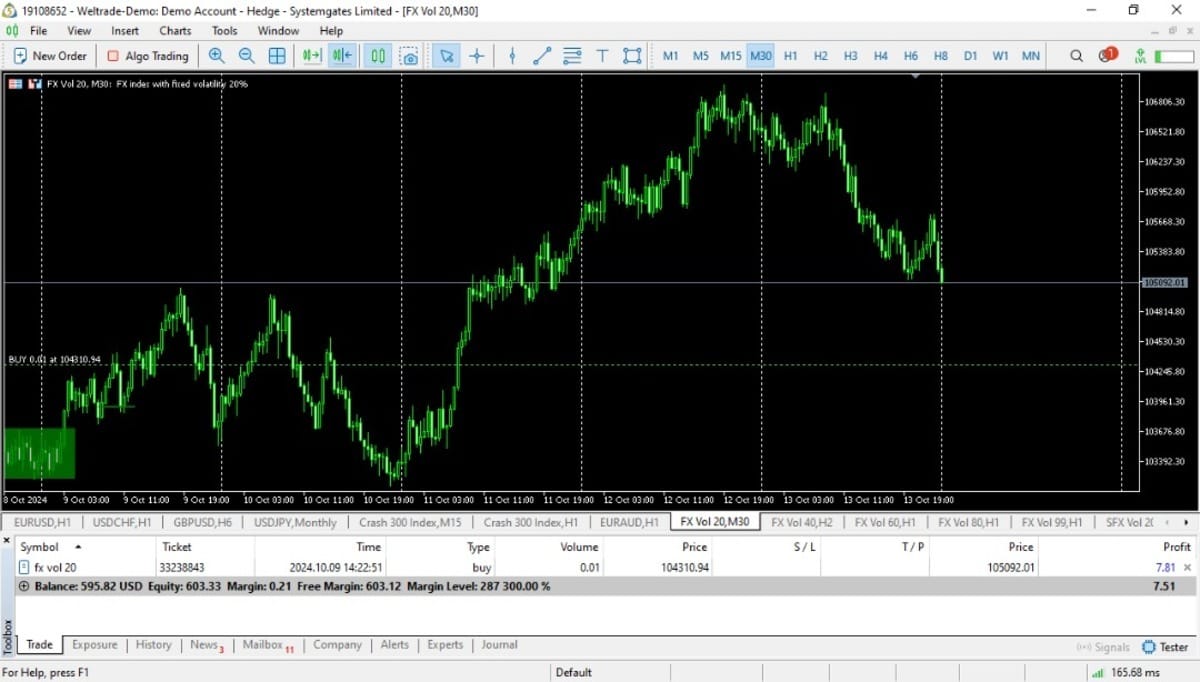

The WelTrade synthetic indices account offers a unique trading experience for clients looking to engage with artificial financial instruments in the Meta Trader 5 terminal. These instruments are 10 in number namely FX Vol 20, 40, 60, 80 99 and SFX Vol 20, 40, 60, 80 and 99. The unique similarity for these instruments is that they simulate the behavior of real-world assets and has the same default micro trading lots. However, they differ from each other in that the volatility in each of the market varies and increases per asset. In addition, the margin value for each of these instruments differ with corresponding up and down spikes per every 30 minutes for the SFX Vol instruments.

These synthetic indices, known as SyntX instruments, allow traders to capitalize on price movements without directly interacting with traditional markets. One of the standout features is that asset like FX Vol 20 can be traded with a minimum deposit of just $1 owing to its margin value of 0.71, thus, making it particularly appealing for beginners or those who want to test their strategies with minimal financial commitment. Moreover, the SyntX market operates 24/7, allowing traders to engage in trading activities at any time without being constrained by traditional market hours. This flexibility is a significant advantage for those who may have other commitments during standard trading hours or for those looking to react quickly to market developments. However, with inherent risks associated with high leverage (1:10,000), traders are encouraged to thoroughly understand these products before committing significant capital.

Step by Step Guide on How to Trade and Make Money on Weltrade Platform

Below are the step by step guide that will help you in your journey of learning how to trade and make money on Weltrade:

Have a Good Knowledge of The Market

This begins with knowing the type of market to trade. Like I often say, the financial market is like a wide ocean. As such, a compass is needed for ease of navigation. In the same way, to easily navigate the financial market, the compass of ‘’a specific financial instrument’’ is important because, all financial markets are driven by different factors.

For instance, the forex market is driven primarily by fundamental factors. Hence, the ability to know and understand the different fundamental factors tend to solve more than 70% of trading problems. Conversely, the crypto market is driven primarily by market perceptions as derived by sentiments. Similarly, the synthetic indices market is driven primarily by technical factors where market participants rely on specific or historical price behaviour to make trading decisions.

Having a good knowledge of these markets helps in guaranteeing a successful outcome in any trading adventure. More so, this is to note that choosing any market of choice should be properly guided using pointers such as trader’s preference, trading experience, and amount of risk capital.

Capitalize on Specific Factors Controlling Each Market

As stated before, different factors control each market and this will be discussed in this session.

The Fundamental Factor

For the Forex market that is controlled by fundamental factors, a good knowledge of factors such as GDP, Interest rates, Taxations, Consumer Price, Producer Price, Employment and Unemployment change helps in knowing how strong or weak a currency can be. With a good knowledge of these factors, long term directional bias can be speculated for a currency relative to the data release for each of these factors. For example, the USD will most likely go long when paired against the CAD if all of these data go positive. For a good understanding of forex fundamentals, websites such as forexfactory.com, investing.com, Bloomberg are used.

The Sentimental Factor

Similarly, trading a market like cryptocurrencies will demand you having a good grasp of details especially market driven sentiments from sites such as CoinMarketCap, and CoinGecko. These sites provide up-to-date information that can influence market sentiment in the cryptocurrency space. Traders often monitor these platforms to gauge overall market mood and potential price movements. Cryptocurrency traders rely heavily on these information sources due to the highly volatile and sentiment-driven nature of the crypto markets. Unlike traditional financial markets, the cryptocurrency space is often influenced by rapid-fire news, social media trends, and community sentiment. This makes staying informed a crucial aspect of successful trading. The importance of these sources stems from the fact that cryptocurrency prices can be highly reactive to news, speculation, and public sentiment. A single tweet from a prominent figure or a sudden regulatory announcement can cause significant price swings in minutes. By staying attuned to these information channels, traders can potentially anticipate market movements and make more informed decisions.

However, it’s crucial to note that while these sources provide valuable information, they should be used as part of a broader trading strategy. Relying solely on sentiment without fundamental analysis or technical trading skills can be risky. Successful cryptocurrency trading typically involves a combination of technical analysis, fundamental understanding of blockchain technology and specific crypto projects, risk management, and the ability to interpret market sentiment from various sources.

The Technical Factor

In trading a market like the synthetic indices, a good knowledge of technical analysis is very important. This is because, synthetic indices thrive on understanding the basis of repeated patterns and peculiar charts. As there are no fundamental and sentimental interferences in this type of market, understanding technical trading based on technical indicators such as moving averages, Bollinger bands and relative strength index. Similarly, technical price action tools such as trendlines, Fibonacci and Elliot Wave tools can also be used. A website like tradingview.com offers a platform where more than 200 technical tools ae provided for analysis.

Understanding the Trading Interface

This is usually done during the demo trading phase. The essence is to acquaint traders with features that will help them become proficient and successful in their trading. This might involve knowing icons that involves buy and sell orders (both instant execution and pending orders), knowing the icons that houses technical indicators, market watchlist, navigation tools, toolbox etc. a good knowledge of these icons help in easing trading pressures especially when seeking to either place or close open positions.

Understanding Forex Market Liquidity and Volatility

One of the most important means of gaining from trading the forex market with WelTrade is by knowing how liquidity and volatility of the market works. While forex market liquidity involves the ease with which currencies can be bought or sold without causing significant price changes, forex volatility involves the degree to which currency prices can fluctuate over time. The impact of these duo is that they enable a large volume of trades to occur with minimal impact on market prices. More so, it allows traders to take the best trades and not try to force trading that could be traps.

Increasing or decreasing Forex market liquidity and volatility varies with trading session. For instance, the highest liquidity in the forex market is observed during the New York Session followed by the London and the Asian session. Trading during the New York session guarantees taking the best trade due to a more trending opportunity that comes with high liquidity and volatility in the market. This is succeeded by the London session while the Asian session has the least trading volatility and liquidity in the market. and more trading opportunities for each trader.

Understanding the relationship between liquidity and volatility allows traders to make informed decisions. High liquidity typically results in tighter spreads and easier trade execution, while low liquidity can lead to wider spreads and increased price swings. Thus, by understanding the role of market trading sessions, traders can have a good trading opportunity in each of the market sessions, their strategies and effectively manage risk during trading.