If you are looking for how to trade SFX Volatility Indices Profitably with WelTrade, then this article was written sorely for you.

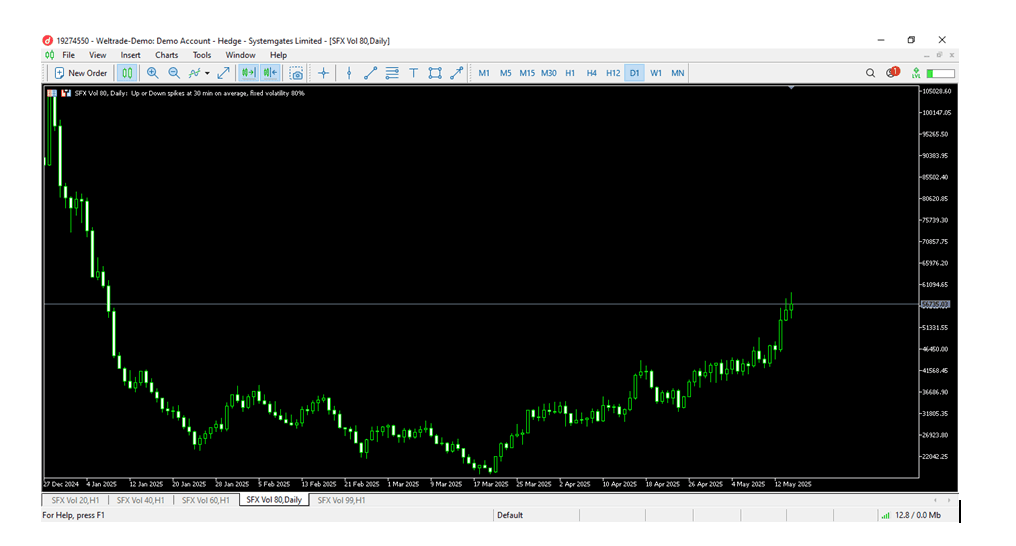

Profitable and successful trading is an exercise that traders believe it follow through a well-defined process. For a trader that loves to specialize in trading SFX volatility series offered by WelTrade broker (identified as Systemgates Limited in the MT5 platform), these well-defined processes could include trading as a day trader, scalper or swinger. This could also be elaborated to mean that a trader who chooses to be scalper, for instance, can choose to scalp using strategies such as price action, indicator trading or a combination of both.

Click here to learn More About Forex and WelTrade

While the subject of a superior strategy remains a debatable topic in the finance world, I am of the opinion that successful trading is more of an individual’s view about the market. This is because, irrespective of the strategy or methodology used in perceiving and interpreting price movement, the aim of all trading exercises end with ‘’the percentage of profit or loss made’’ in each open position.

Table of Contents

How to Trade SFX Volatility Indices Profitably with WelTrade

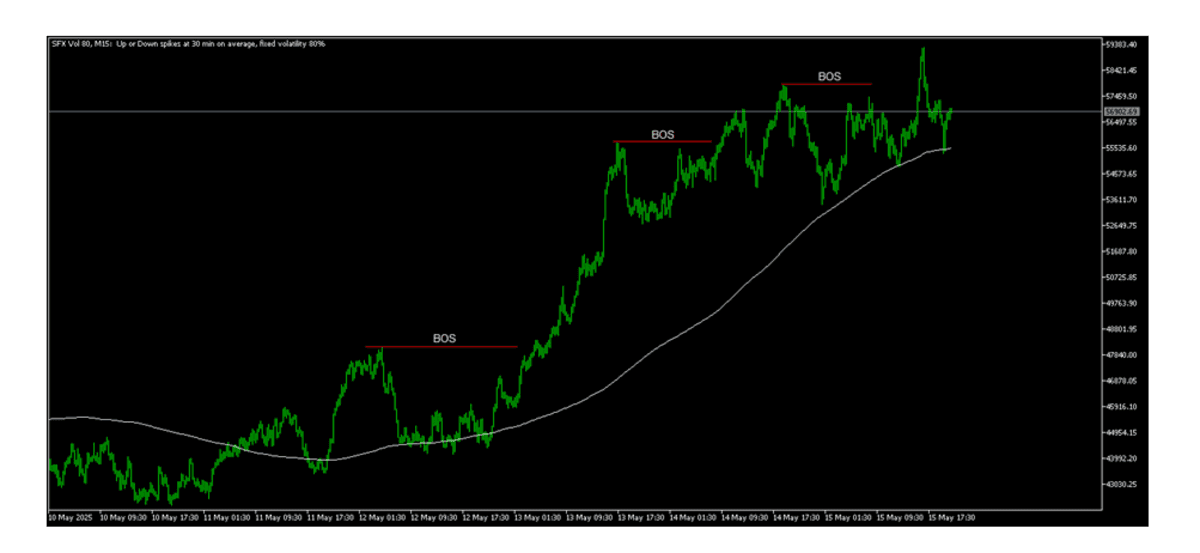

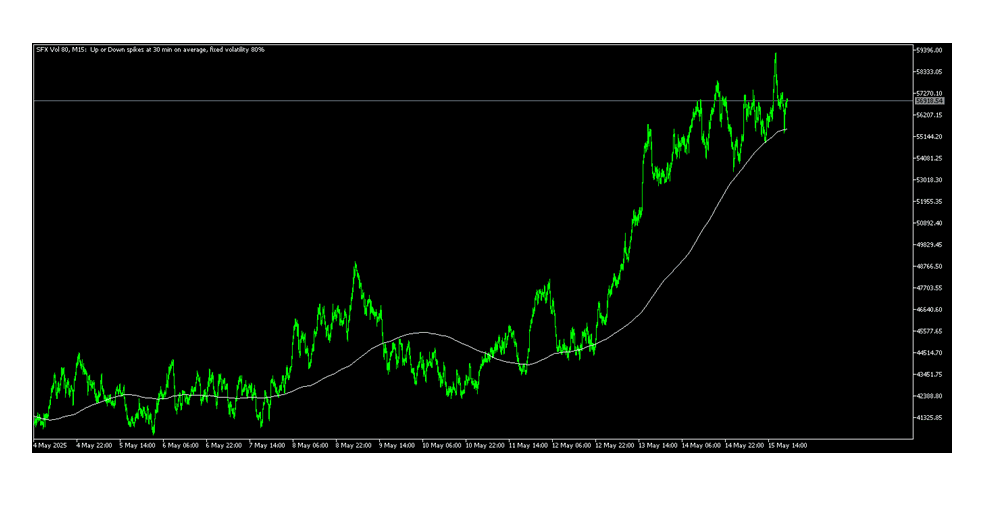

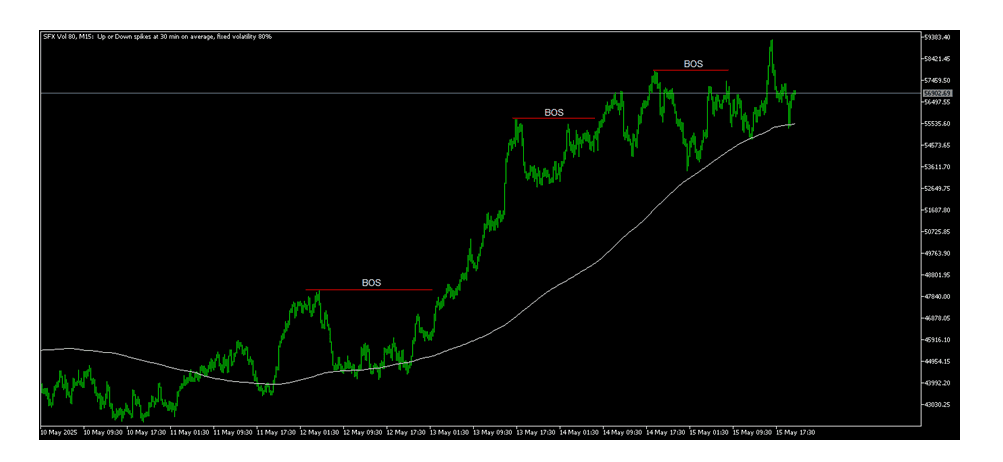

As mentioned before, some of the most time-proven strategies used in successful trading includes trading with price action strategies, indicators and, or a combination of both.

Price Action Trading Strategies

In trading with price action, emphasis is laid on price movement. What this means is that, a trader who focuses on price action primarily engages by trading the naked chart. Here, no technical indicators are allowed. As naked as the chart is, the trader accepts what he is and follows the direction of price using repeated patterns and historical observations such as the M and W pattern, the Head and Shoulders, the rising and falling wedges, etc.,

With an ardent attention given to these patterns and repeated occurrences over time, a trader is able to forecast future price movements with confidence. However, this is not to say that violations of this price patterns do not occur. Certainly, they do. But then, it is certain that 70% of the times, these patterns do not fail to produce forecasts that are always predictable and dependable in trading. More so, how well a trader maximizes this knowledge depends on his mastery level in price action trading.

Furthermore, price action trading is not limited to patterns and historical repeated occurrences. Many traders in historical times have also developed personal concepts that has become widely accepted over the years. These could include concepts or strategies such as the smart money concept, the online trading academy concept, the Quasimodo pattern concept, the Elliot wave concept, the John Magee trading systems etc.,

More so, it will not be out of place if by tomorrow, a group of traders also develop their trading concept because, the beauty of trading is in its dynamic views that many traders hold.

Indicator Trading Strategies

Indicator trading is a type of technical trading that involves the use of technical tools for ease of analysis and visual representations of the market behavior for enhanced and informed decision making processes.

Indicators are divided into trend trading indicators, oscillators, volumes, bill Williams and custom indicators. Examples of trend indicators includes moving average and Bollinger Band. Examples of Oscillators include Moving Average Convergence Divergence (MACD), Stochastics etc.

While trend indicators helps traders to follow price directions based on defined patterns, volume and Bill Williams indicators help in assessing momentum of participants and trend directions. Since trend is used to follow buy and sell directions, momentum indicators can be used to determine the buy and sell pressure within the trend. On the other hand, custom indicators could be tweaked and programmed by coders and developers to suit a particular purpose.

While these technical tools are employed for their versatility in trading, they are often critiqued for being lagging. As such, many trader feels that it leaves them behind especially where trend movements are sought out for with sniper entries.

Despite this fallback, an indicator trader can still turn out fine if he or she decides to follow the path of patience and use these technical tools justly.

Combining Price Action and Indicator Trading Strategies

Utilizing this double edged strategy requires a trader to understand the pros and cons of each trading strategy. This is because, when a trader is not well versed, he or she can be confused and then take poor trading decisions based on this. However, where a precise understanding of both are merged together, a trader may tend to have an edge about what price is doing and where it may go because, a combination of both strategies provide reliable confirmations that cannot be mistaken.

Furthermore, combining both strategies helps traders to filter out false signals, improve the accuracy of trade entries and exits, and gain a more comprehensive understanding of market conditions by confirming price movements with technical indicators. This integrated approach enhances decision-making, reduces risk, and increases the probability of successful trades by aligning price action insights with indicator confirmations.

Looking at both strategies, it is obvious that combining strategies are as effective as if a trader uses either of them. However, where a nuanced understating is not well comprehended, the efficacy of results produced is usually a failing one. For that reason, choosing a particular strategy for trading purposes should be based on the individual’s understanding of the pros and cons of each strategy chosen.

Effective Risk Management

This is the king-pin of all forms of successful trading strategies. Risk management simply means, knowing the worth of a particular trade when compared to how much a trader is willing to lose. It involves the act of thinking through the potential gain and loss that a trader could incur when he or she takes an open position. Usually, risk management is often expressed as the percentage risk to reward ratio for a trader.

Without effective risk management, sustainability in trading is just a mere wish. This is because, effective risk management is the missing piece between successful traders and losing traders. While risk management may imply knowing the kind of trades to take based on the potential risk to reward for any open position, it implies that a trader must learn to know when to take a trade and when to avoid taking a trade. Therefore, to successfully trade SFX volatility series, one must understand the following

- The Margin requirement for each SFX Volatility asset. This is because, the margin count is different for each

- The potential risk to reward percentage for each trade. While many traders always suggest a fixed risk and a dynamic reward ratio, I will suggest that every trader should find out what works for him or her. There are no fixed rules in the trading arena

- Know your excitement, pain and endurance threshold. It is certain that not all traders can hold trades for long. While I always encourage traders to learn the art of taking long term trades, it is a fact that all of us are not the same. Therefore, knowing the excitement, pain and endurance threshold can help to limit the challenges of burnout in trading.

Final Thoughts on How to Trade Profitably SFX Vol Successfully

By following the strategies outline in this article, it is believed that your journey in trading the SFX Volatility series will be successful.

Please do not forget that in trading, no strategy or methodology is superior to the other. Kindly discover, follow and stick to what works for you. Avoid the competition at all means and focus on the goals ahead. See you on top.

Click here to get The Master Hack on Trading FX with Weltrade